the 2minute rule for what does cfa stand for in finance

The exchange of two securities, rate of interest, or currencies for the mutual advantage of the exchangers. For example, in a rates of interest swap, the exchangers gain access to rates of interest available only to the other exchanger by switching them. In this case, the 2 legs of the swap are a set rates of interest, say 3. 5 %, and a floating rate of interest, say LIBOR +0. 5 %. In such a swap, the only things traded are the 2 interest rates, florida timeshare cancellation letter which are calculated over a notional value. Each party pays the other at set intervals over the life of the swap. 5 %rates of interest computed over a notional worth of$ 1 million, while the 2nd celebration might accept pay LIBOR+ 0.

.

5% over the same notional value. It is very important to note that the notional amount is approximate and is not in fact traded. Farlex Financial Dictionary. 2012 Farlex, Inc. All Rights Reserved Aagreement in which 2 celebrations agree to exchange routine interest payments. In the most typical kind of swap plan, one party concurs to pay set interest payments on designated dates to a counterparty who, in turn, accepts make return interest payments that drift with some referral rate such as the rate on Treasury costs or the prime rate . See likewise counterparty threat. To trade one asset for another. Likewise called exchange, replacement, switch. Wall Street Words: An A to Z Guide to Financial Investment Terms for Today's Investor by David L. Scott. Copyright 2003 by Houghton Mifflin Company. Published by Houghton Mifflin Company. All rights scheduled. All rights reserved. When you swap or exchange securities, you sell one security and purchase a similar one nearly simultaneously. Swapping enables you to change the maturity or the quality of the holdings in your portfolio. You can likewise utilize swaps to realize a capital loss for tax functions by selling securities that have actually decreased in value considering that you bought them. the bilateral (and multilateral )exchange of a product, organization asset, rates of interest on a financial debt, or currency for another item , business asset, rates of interest on a financial debt, or currency, respectively; item swaps: person A provides potatoes to individual B in exchange for a bicycle. See BARTER; company asset swaps: chemical company An offers its ethylene department to chemical business B in exchange for B's paint department. This allows both business to divest( see DIVESTMENT) parts of their service they no longer want to maintain while all at once getting in, or strengthening their position in, another item area; INTEREST-RATE swaps on monetary debts: a company that has a variable-rate debt, for example, might expect that rate of interest will increase; another company with fixed-rate debt may anticipate that rate of interest will fall. 40 per euro, then Company C's payment equals $1,400,000, and Company D's payment would be $4,125,000. In practice, Company D would pay the net distinction of $2,725,000 ($ 4,125,000 $1,400,000) to Company C. Then, at intervals defined in the swap contract, the celebrations will exchange interest payments on their respective principal quantities. To keep things basic, let's say they make these payments every year, beginning one year from the exchange of principal. Because Business C has actually obtained euros, it should pay interest in euros based on a euro rates of interest. Similarly, Business D, which obtained dollars, will pay interest in dollars, based on a dollar rate of interest.

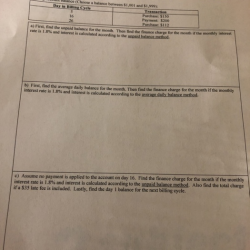

25%, and the euro-denominated rate of interest is 3. 5%. Therefore, each year, Company C pays 1,400,000 euros (40,000,000 euros * 3. 5%) to Business D. Which results are more likely for someone without personal finance skills? Check all that apply.. Company D will pay Company C $4,125,000 ($ 50,000,000 * 8. 25%). Figure 3: Money flows for a plain vanilla currency swap, Step 2 Finally, at the end of the swap (typically also the date of the final interest payment), the parties re-exchange the initial principal amounts. These principal payments are untouched by exchange rates at the time. Figure 4: Cash streams for a plain vanilla currency swap, Action 3 The motivations for utilizing swap agreements fall under two fundamental categories: industrial needs and relative advantage.

For example, think about a bank, which pays a floating interest rate on deposits (e. g., liabilities) and earns a set interest rate on loans (e. g., properties). This inequality between possessions and liabilities can cause tremendous difficulties. The bank might use a fixed-pay swap (pay a fixed rate and receive a floating rate) to convert its fixed-rate properties into floating-rate properties, which would match up well with its floating-rate liabilities. Some companies have a relative advantage in getting particular kinds of funding. However, this relative advantage may not be for the kind of funding preferred. In this case, the business may obtain the financing for which it has a relative advantage, then use a swap to transform it to the preferred kind of financing.

Things about How Old Of An Rv Can You Finance

firm that desires to broaden its operations into Europe, where it is less understood. It will likely get more beneficial funding terms in the U.S. By using a currency swap, the firm winds up with the euros it requires to money its growth. To leave a swap agreement, either buy out the counterparty, enter a balancing out swap, offer the swap to someone else, or utilize a swaption. Often among the swap parties requires to leave the swap prior to the agreed-upon termination date. This resembles a financier selling exchange-traded futures or options contracts prior to expiration. There are four basic methods to do this: 1.

Nevertheless, this is not an automated function, so either it should be specified in the swaps agreement ahead of time, or the party who desires out need to secure the counterparty's permission. 2. Get In an Offsetting Swap: For instance, Company A from the interest rate swap example above could participate in a 2nd swap, this time getting a set rate and paying http://shanexgds257.trexgame.net/a-biased-view-of-what-happened-to-yahoo-finance-portfolios a floating rate. 3. Offer the Swap to Another Person: Since swaps have calculable worth, one party might sell the contract to a third party. Similar to Technique 1, this requires the authorization of the counterparty. 4. Use a Swaption: A swaption is an alternative on a swap.

A swap is a acquired contract through which 2 celebrations exchange the cash streams or liabilities from 2 various financial instruments. A lot of swaps include money flows based on a notional principal amount such as a loan or bond, although the instrument can be practically anything. Generally, the principal does not change hands. Each cash flow consists of one leg of the swap. One capital is usually repaired, while the other varies and based on a benchmark rates of interest, floating currency exchange rate, or index price. The most common kind of swap is an rates of interest swap. Swaps do not trade on exchanges, and retail financiers do not normally take part in swaps.

In a rate of interest swap, the celebrations exchange money streams based on a notional principal amount (this quantity is not in fact exchanged) in order to hedge against interest rate danger or to speculate. For instance, picture ABC Co. has just issued $1 million in five-year bonds with a variable yearly rates of interest specified as the London Interbank Offered Rate (LIBOR) plus 1. 3% (or 130 basis points). Likewise, presume that LIBOR is at 2. 5% and ABC management is anxious about an interest rate rise. The management group discovers another business, XYZ Inc., that is ready to pay ABC an annual rate of LIBOR plus 1.

In other words, XYZ will money ABC's interest payments on its most current bond issue. In exchange, ABC pays XYZ a set yearly rate of 5% on what happens if i don't pay my timeshare maintenance fees a notional worth of $1 million for 5 years. ABC benefits from the swap if rates increase considerably over the next 5 years. XYZ benefits if rates fall, stay flat, or rise just slowly. According to a statement by the Federal Reserve, banks must stop composing agreements using LIBOR by the end of 2021. The Intercontinental Exchange, the authority responsible for LIBOR, will stop publishing one week and two month LIBOR after December 31, 2021.

All about Which One Of The Following Occupations Best Fits Into The International Area Of Finance?

Below are two circumstances for this rates of interest swap: LIBOR increases 0. 75% annually and LIBOR increases 0. 25% annually. If LIBOR increases by 0. 75% per year, Company ABC's total interest payments to its shareholders over the five-year duration quantity to $225,000. Let's break down the computation: 3. 80% $38,000 $50,000 -$ 12,000 $12,000 4. 55% $45,500 $50,000 -$ 4,500 $4,500 5. 30% $53,000 $50,000 $3,000 -$ 3,000 6. 05% $60,500 $50,000 $10,500 -$ 10,500 6. 80% $68,000 $50,000 $18,000 -$ 18,000 $15,000 ($ 15,000) In this situation, ABC did well because its rate of interest was fixed at 5% through the swap. ABC paid $15,000 less than it would have with the variable rate.

Ingen kommentarer endnu